Looking for the best stock broker in India? Compare the top 10 stock broker in India based on brokerage charges, trading platforms, account opening fees, and us

Looking for the best stock broker in India? Compare the top 10 stock broker in india based on brokerage charges, trading platforms, account opening fees, and user reviews. Find the perfect one to start your investment journey!

Choosing Wisely: Finding the Best Stock Broker in India

Navigating the Indian Stock Market Landscape

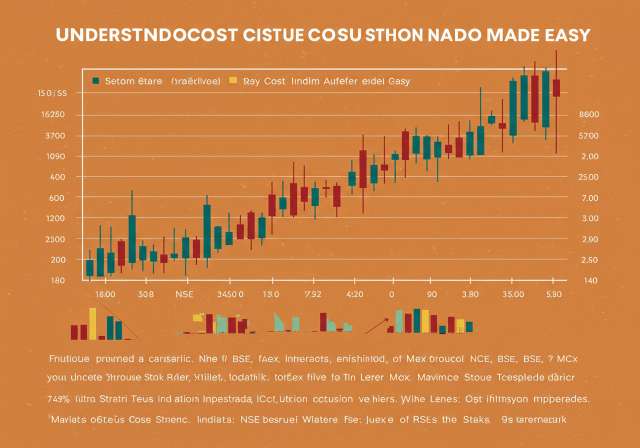

The Indian stock market is a dynamic and exciting space, offering immense opportunities for wealth creation. Whether you’re a seasoned investor or just starting, having the right stock broker is crucial. A good broker provides not only access to the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) but also the tools, research, and support you need to make informed investment decisions. This guide will explore the factors to consider when selecting a broker and then delve into some of the prominent players in the Indian broking arena.

Key Considerations When Choosing a Stock Broker

Before diving into specific brokers, let’s outline the key factors that should influence your decision:

- Brokerage Charges: This is perhaps the most obvious factor. Brokers charge a fee (brokerage) for executing trades. These charges can significantly impact your overall returns, especially for frequent traders. Look for brokers with transparent and competitive pricing structures. Many brokers now offer flat-fee pricing or percentage-based brokerage, with the latter often having a maximum cap.

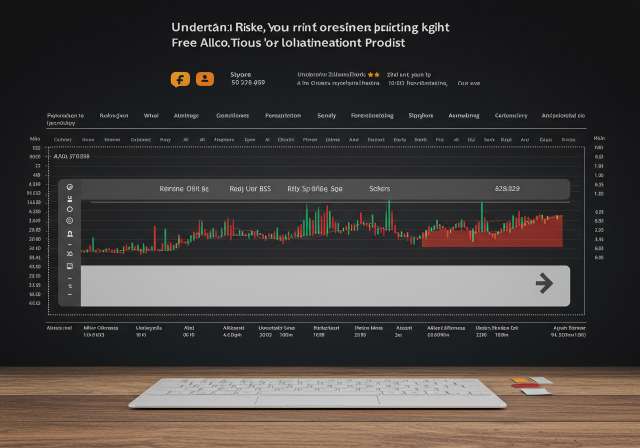

- Trading Platform: A user-friendly and robust trading platform is essential. It should offer real-time market data, charting tools, order placement options, and portfolio tracking. Mobile apps are also increasingly important for trading on the go.

- Account Opening and Maintenance Fees: Some brokers charge account opening fees and annual maintenance charges (AMC). Compare these fees across different brokers to minimize your overall costs. Zero AMC accounts are becoming more common.

- Research and Advisory Services: Access to high-quality research reports, stock recommendations, and advisory services can be invaluable, especially for beginners. Some brokers offer free research, while others provide premium services for an additional fee. Evaluate the quality and relevance of the research offered.

- Customer Service: Responsive and helpful customer service is crucial, especially when you encounter issues or have questions. Check customer reviews and ratings to assess the quality of customer support provided by different brokers.

- Range of Investment Options: Ensure the broker offers access to the investment options you’re interested in, such as equity, derivatives (futures and options), commodities, IPOs (Initial Public Offerings), and mutual funds.

- Margin and Leverage: Understand the margin and leverage offered by the broker and use them responsibly. While leverage can amplify potential gains, it can also magnify losses. SEBI has regulations in place to manage leverage levels.

- Security and Reliability: Choose a broker with a strong track record of security and reliability. Look for brokers that use advanced security measures to protect your account and personal information. Ensure the broker is registered with SEBI (Securities and Exchange Board of India), the regulatory body for the Indian stock market.

- Educational Resources: If you’re new to investing, look for brokers that offer educational resources, such as articles, videos, and webinars. These resources can help you learn the basics of investing and improve your trading skills.

- Technology and Innovation: Brokers are increasingly leveraging technology to offer innovative features and services. Look for brokers that offer features like robo-advisory, automated trading, and advanced charting tools.

Top Brokers in India: A Closer Look

Now, let’s explore some of the top brokers in India, considering the factors mentioned above. This list is not exhaustive and is intended to provide a starting point for your research. Remember to conduct thorough due diligence before choosing a broker.

1. Zerodha

Zerodha is arguably the most popular discount broker in India, known for its low brokerage charges and user-friendly platform, Kite. They offer equity delivery trades for free and charge a flat fee of ₹20 for intraday and F&O trades. Zerodha has a large and active user base and provides a wide range of educational resources. Their focus on technology and innovation has made them a leader in the discount broking space.

2. Upstox

Upstox is another prominent discount broker that offers low brokerage charges and a modern trading platform. They offer a free account opening and charge a flat fee for intraday and F&O trades. Upstox is backed by prominent investors and has gained significant market share in recent years. They offer access to stocks, futures, options, commodities, and mutual funds.

3. Angel One

Angel One (formerly Angel Broking) is a well-established full-service broker that has transitioned to a discount broking model. They offer a range of services, including research, advisory, and portfolio management. They provide both flat-fee and percentage-based brokerage options. Angel One’s strong research capabilities and widespread branch network make them a popular choice among investors.

4. Groww

Groww is a popular platform for investing in mutual funds and stocks. They offer a simple and intuitive user interface, making it easy for beginners to get started. Groww charges zero commission for mutual fund investments and offers competitive brokerage rates for stocks. They are known for their focus on user experience and educational content.

5. ICICI Direct

ICICI Direct is a leading full-service broker offered by ICICI Securities, a subsidiary of ICICI Bank. They offer a wide range of investment products and services, including equity, derivatives, IPOs, mutual funds, and fixed income. ICICI Direct provides comprehensive research reports and advisory services. Their 3-in-1 account (trading, demat, and bank account) simplifies the investment process.

6. HDFC Securities

HDFC Securities is another prominent full-service broker offered by HDFC Bank. They offer a similar range of products and services as ICICI Direct, including research, advisory, and portfolio management. HDFC Securities is known for its strong brand reputation and reliable customer service. They also offer a 3-in-1 account for seamless trading and banking.

7. Kotak Securities

Kotak Securities is the broking arm of Kotak Mahindra Bank. They provide a wide range of investment solutions, including equity, derivatives, mutual funds, and IPOs. Kotak Securities offers both online and offline trading options. They are known for their competitive brokerage rates and strong research capabilities.

8. Motilal Oswal

Motilal Oswal is a well-known full-service broker with a strong focus on research and advisory services. They offer a wide range of investment products, including equity, derivatives, mutual funds, and portfolio management services (PMS). Motilal Oswal is known for its in-depth research reports and personalized investment advice.

9. 5paisa Capital

5paisa Capital is a discount broker that offers a flat-fee brokerage model. They charge a flat fee of ₹20 per trade, regardless of the trade size. 5paisa Capital offers a range of features, including automated trading and robo-advisory. They are focused on providing a cost-effective and technology-driven trading experience.

10. IIFL Securities

IIFL Securities (formerly India Infoline) is a full-service broker that offers a wide range of investment products and services, including equity, derivatives, mutual funds, and commodities. They provide research and advisory services and have a strong presence in both online and offline channels. IIFL Securities is known for its comprehensive investment solutions and customer-focused approach.

Full-Service Brokers vs. Discount Brokers

It’s important to understand the difference between full-service brokers and discount brokers. Full-service brokers offer a wider range of services, including research, advisory, and personalized investment advice. They typically charge higher brokerage fees than discount brokers. Discount brokers, on the other hand, focus on providing a low-cost trading platform and typically offer limited research and advisory services. The choice between a full-service broker and a discount broker depends on your individual needs and investment style.

The Rise of Discount Broking in India

Discount broking has gained immense popularity in India in recent years, driven by the increasing demand for low-cost trading solutions. Discount brokers have disrupted the traditional broking industry by offering lower brokerage charges and user-friendly platforms. This has made investing more accessible to a wider range of investors, particularly millennials and Gen Z.

Beyond Stock Trading: Other Investment Options

While this article focuses on stock brokers, it’s important to remember that the Indian financial market offers a wide range of other investment options, including:

- Mutual Funds: A popular option for diversifying your investments. You can invest in equity mutual funds, debt mutual funds, or hybrid mutual funds. Systematic Investment Plans (SIPs) allow you to invest a fixed amount regularly.

- ELSS (Equity Linked Savings Scheme): Tax-saving mutual funds that invest primarily in equity. They offer tax benefits under Section 80C of the Income Tax Act.

- PPF (Public Provident Fund): A long-term savings scheme offered by the government. It offers tax benefits and a guaranteed return.

- NPS (National Pension System): A retirement savings scheme that allows you to invest in a mix of equity and debt.

- Fixed Deposits (FDs): A traditional investment option that offers a fixed rate of return.

- Bonds: Debt instruments issued by companies or the government.

Conclusion: Choosing the Right Broker for You

Selecting the right stock broker is a crucial step in your investment journey. The ideal choice depends on your individual needs, investment style, and risk tolerance. Carefully consider the factors mentioned above, research different brokers, and compare their offerings before making a decision. Remember that past performance is not indicative of future results. Investing in the stock market involves risk, and you should only invest money that you can afford to lose. By choosing a reputable broker and investing wisely, you can increase your chances of achieving your financial goals. Always remember to consult with a financial advisor before making any investment decisions.