Looking for the india best stock broker to navigate the Indian stock market? Compare brokerage fees, trading platforms, research tools, and account features to

Looking for the india best stock broker to navigate the Indian stock market? Compare brokerage fees, trading platforms, research tools, and account features to find the perfect fit. Start investing wisely today!

Find Your Perfect Match: Choosing the Best Stock Broker in India

Introduction: Navigating the Indian Stock Market

The Indian stock market offers exciting opportunities for wealth creation. With the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) providing platforms for trading, understanding how to participate is crucial. A vital component of this participation is selecting the right stock broker. Your stock broker acts as your intermediary, facilitating your trades and providing access to market information and investment tools. But with so many options available, choosing the right one can feel overwhelming. This article will guide you through the process of selecting a stock broker in India, focusing on factors that matter most to both beginners and experienced investors.

Understanding Your Investment Needs

Before diving into comparing brokers, take a moment to assess your individual investment needs and goals. Ask yourself the following questions:

- What is your investment style? Are you a long-term investor focused on value investing, or a short-term trader seeking quick profits?

- What types of securities are you interested in trading? Equities (stocks), derivatives (futures and options), commodities, currency trading, or a combination?

- What is your risk tolerance? Are you comfortable with high-risk, high-reward investments, or do you prefer a more conservative approach?

- What is your budget for brokerage fees and other charges?

- What level of support and research do you need? Are you a self-directed investor, or do you require assistance from a financial advisor?

Answering these questions will help you narrow down your choices and identify brokers that align with your specific requirements.

Key Factors to Consider When Choosing a Stock Broker

Here are some crucial factors to evaluate when selecting a stock broker in India:

Brokerage Fees and Charges

Brokerage fees are the charges levied by the broker for executing trades. These fees can vary significantly between different brokers. Common types of brokerage charges include:

- Percentage-based brokerage: A percentage of the transaction value.

- Flat-fee brokerage: A fixed fee per trade, regardless of the transaction value.

- Discount brokerage: Lower brokerage fees, often with limited services.

- Full-service brokerage: Higher brokerage fees, but with access to research, advisory services, and personalized support.

Pay close attention to other charges as well, such as account opening fees, annual maintenance charges (AMC), Demat account charges, transaction charges levied by the exchanges (NSE and BSE), SEBI turnover fees, and Goods and Services Tax (GST). Compare these charges carefully to understand the total cost of trading.

Trading Platform and Technology

The trading platform is your gateway to the stock market. A user-friendly and reliable platform is essential for efficient trading. Look for the following features:

- Intuitive interface: Easy to navigate and understand.

- Real-time market data: Up-to-date information on stock prices and market movements.

- Charting tools: Technical analysis tools for identifying trading opportunities.

- Order placement options: Various order types, such as market orders, limit orders, and stop-loss orders.

- Mobile app: Ability to trade on the go from your smartphone or tablet.

- Security: Robust security measures to protect your account and data.

Many brokers offer demo accounts that allow you to test the platform before committing. Take advantage of these opportunities to evaluate the platform’s functionality and ease of use.

Research and Analysis Tools

Access to high-quality research and analysis can significantly improve your investment decisions. Look for brokers that provide:

- Company reports: Detailed information on company financials, performance, and prospects.

- Industry analysis: Insights into industry trends and competitive landscapes.

- Stock recommendations: Buy, sell, and hold recommendations from analysts.

- Technical analysis tools: Charts, indicators, and other tools for identifying trading patterns.

- Educational resources: Articles, webinars, and other resources to help you learn about investing.

The value of research and analysis depends on your investment style and experience. If you are a beginner, access to reliable research can be invaluable. Experienced investors may still benefit from independent research to supplement their own analysis.

Customer Support and Service

Reliable customer support is essential in case you encounter any issues or have questions about your account or trading. Look for brokers that offer:

- Multiple channels of communication: Phone, email, and live chat.

- Prompt and helpful responses: Quick resolution of your queries and issues.

- Knowledgeable support staff: Ability to answer your questions accurately and efficiently.

- Dedicated relationship manager: Personalized support from a designated representative (often available with full-service brokers).

Check online reviews and ratings to gauge the quality of customer support provided by different brokers.

Account Features and Offerings

Consider the other account features and offerings provided by the broker, such as:

- Demat account: Necessary for holding shares in electronic form.

- Trading account: Used to execute trades.

- Margin trading: Ability to borrow funds to trade (use with caution).

- IPO access: Opportunity to apply for shares in initial public offerings (IPOs).

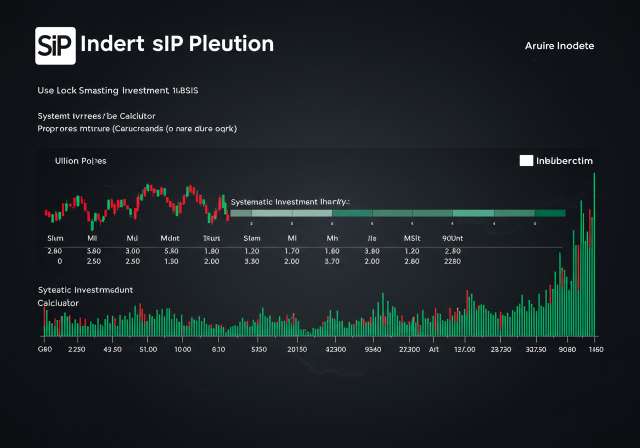

- Mutual fund investments: Platform to invest in mutual funds, including SIPs and ELSS funds.

- Currency trading: Opportunity to trade in currency derivatives.

- Commodity trading: Opportunity to trade in commodity futures.

Ensure that the broker offers the account features and investment options that you need.

Regulatory Compliance and Security

It is crucial to choose a broker that is regulated by the Securities and Exchange Board of India (SEBI) and adheres to all applicable regulations. This ensures that your funds and investments are protected. Check the broker’s SEBI registration number and verify its validity on the SEBI website. Also, look for brokers that have robust security measures in place to protect your account and data from cyber threats.

Comparing Different Types of Stock Brokers in India

Stock brokers in India can be broadly classified into the following categories:

Full-Service Brokers

Full-service brokers offer a wide range of services, including research, advisory, trading platform, and personalized support. They typically charge higher brokerage fees than discount brokers. Full-service brokers are suitable for investors who value personalized advice and require assistance with their investment decisions.

Discount Brokers

Discount brokers offer a basic trading platform and limited services at lower brokerage fees. They are suitable for self-directed investors who do not require extensive research or advisory services. Discount brokers often focus on providing a cost-effective trading experience.

Online Brokers

Online brokers operate primarily online and offer a convenient and efficient trading experience. They typically offer a user-friendly trading platform, access to research, and competitive brokerage fees. Online brokers are suitable for investors who are comfortable trading online and prefer a self-directed approach.

The Role of Technology in Modern Broking

Modern broking is heavily reliant on technology. Algorithmic trading, automated trading platforms, and sophisticated analytical tools are now commonplace. While selecting a stock broker, assess their technological capabilities and ensure that they offer a seamless and secure trading experience. Consider factors like platform stability, mobile app functionality, and the availability of advanced charting tools.

Beyond Equity: Exploring Other Investment Avenues Through Your Broker

Your stock broker isn’t just for equity trading. Most brokers offer access to a wide range of investment products, including:

- Mutual Funds: Invest in diversified portfolios through Systematic Investment Plans (SIPs) or lump-sum investments. Consider Equity Linked Savings Schemes (ELSS) for tax benefits under Section 80C of the Income Tax Act.

- Derivatives: Trade in futures and options to hedge your portfolio or speculate on market movements.

- Initial Public Offerings (IPOs): Apply for new shares being offered by companies listing on the stock exchange.

- Bonds and Debentures: Invest in fixed-income securities issued by corporations or the government.

- Sovereign Gold Bonds (SGBs): Invest in gold without physical possession, earning interest and benefiting from price appreciation.

Choosing a broker that offers a comprehensive suite of investment options allows you to diversify your portfolio and manage your risk effectively.

Due Diligence: Checking Credentials and Reviews

Before finalizing your choice, perform thorough due diligence. Verify the broker’s SEBI registration details and read online reviews from other investors. Check for any complaints or disciplinary actions against the broker. This step is crucial to ensure that you are dealing with a reputable and trustworthy firm.

Tax Implications and Broker’s Role

Understanding the tax implications of your investments is crucial. Capital gains tax, dividend tax, and other taxes apply to stock market investments. Your broker can provide you with statements and reports that will assist you in filing your tax returns. However, it’s always best to consult with a qualified tax advisor for personalized advice.

Conclusion: Making an Informed Decision

Choosing the right stock broker is a crucial step towards achieving your financial goals. By carefully considering your investment needs, comparing different brokers, and conducting thorough due diligence, you can find a broker that aligns with your requirements and helps you navigate the Indian stock market with confidence. Remember that investment decisions carry inherent risks, so it’s essential to invest wisely and consult with a financial advisor if needed. While this article provides information and guidance, the ultimate decision of choosing the india best stock broker rests with you, the investor.