Unlock your investment potential! Discover the top 10 Indian stock broker platforms in 2024. Compare brokerage fees, features, user experience and more to find

Unlock your investment potential! Discover the top 10 indian stock broker platforms in 2024. Compare brokerage fees, features, user experience and more to find the best fit for your trading needs and achieve your financial goals. Start investing today!

Choosing Wisely: Navigating the Top Indian Stock Brokers in 2024

Introduction: The Gateway to Indian Equity Markets

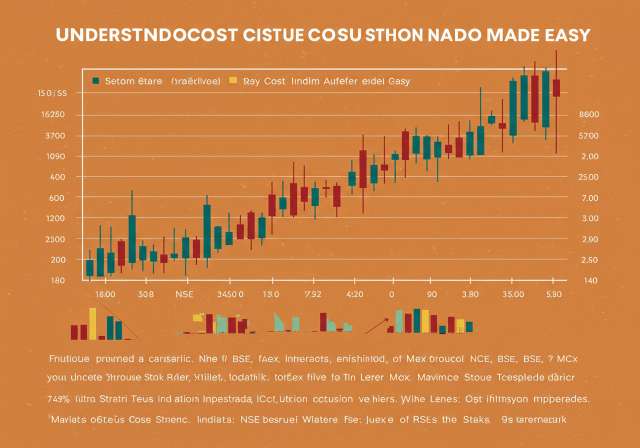

The Indian stock market, with its vibrant NSE (National Stock Exchange) and BSE (Bombay Stock Exchange), offers tremendous opportunities for wealth creation. However, navigating this dynamic landscape requires a reliable and efficient stockbroker. A stockbroker acts as your intermediary, providing access to trading platforms, research tools, and other essential services. Selecting the right broker is crucial for a seamless and profitable investment journey. This article delves into the key considerations for choosing a stockbroker in India and highlights some of the leading contenders in the market.

Key Considerations When Selecting a Stockbroker

Before diving into specific broker names, it’s essential to understand the factors that influence your decision. These include:

Brokerage Fees and Charges

Brokerage fees can significantly impact your returns, especially for frequent traders. Understand the fee structure – is it a percentage-based commission, a flat fee per trade, or a subscription-based model? Also, be aware of other charges such as account opening fees, Demat account maintenance charges, and transaction charges.

Trading Platform and User Experience

A user-friendly and intuitive trading platform is paramount. The platform should offer real-time market data, charting tools, order placement options, and portfolio tracking features. Mobile app availability is also a significant advantage for trading on the go.

Investment Options

Consider the range of investment options offered by the broker. Do they provide access to equities, derivatives (futures and options), commodities, currencies, IPOs, mutual funds, and other investment products? Choose a broker that caters to your diverse investment needs.

Research and Advisory Services

Access to quality research reports, market analysis, and investment recommendations can greatly enhance your decision-making process. Some brokers provide in-house research teams, while others offer access to third-party research providers.

Customer Support

Reliable and responsive customer support is crucial, especially when you encounter technical issues or have queries about your account. Evaluate the availability of customer support channels – phone, email, chat, and in-person assistance (if applicable).

Account Security

Ensure that the broker employs robust security measures to protect your account and personal information. Look for features such as two-factor authentication, encryption, and regular security audits.

Regulation and Compliance

The broker must be regulated by SEBI (Securities and Exchange Board of India), the regulatory body for the Indian securities market. SEBI ensures fair market practices and investor protection.

The Indian Broking Landscape: A Diverse Ecosystem

The Indian broking industry is broadly categorized into two main types:

- Full-Service Brokers: These brokers offer a comprehensive range of services, including research, advisory, wealth management, and access to various investment products. They typically charge higher brokerage fees compared to discount brokers.

- Discount Brokers: These brokers primarily focus on providing a low-cost trading platform for executing trades. They offer minimal research and advisory services, catering to experienced traders who make their own investment decisions.

Top Contenders in the Indian Broking Arena

The following is not an exhaustive list, nor is it a recommendation to use any particular broker. Individual investors should conduct their own research and due diligence before selecting a broker.

1. Zerodha

Zerodha is a leading discount broker in India, known for its low brokerage fees and user-friendly platform, Kite. They offer access to equities, derivatives, mutual funds, and IPOs.

2. Upstox

Upstox is another popular discount broker that provides a seamless trading experience through its mobile app and web platform. They offer competitive brokerage rates and a range of investment options.

3. Angel One (formerly Angel Broking)

Angel One is a well-established full-service broker that has transitioned to a technology-driven approach. They offer a wide range of services, including research, advisory, and margin trading facilities.

4. ICICI Direct

ICICI Direct is the broking arm of ICICI Bank, offering a comprehensive suite of investment products and services. They provide access to equities, derivatives, mutual funds, IPOs, and fixed deposits. Their 3-in-1 account (banking, Demat, and trading) is particularly convenient for ICICI Bank customers.

5. HDFC Securities

HDFC Securities is another prominent full-service broker associated with HDFC Bank. They offer a wide range of investment options, research reports, and personalized advisory services.

6. Kotak Securities

Kotak Securities is the broking arm of Kotak Mahindra Bank, providing a range of investment products and services to its customers. They offer access to equities, derivatives, mutual funds, and IPOs.

7. Groww

Groww is a popular platform known for its simple and intuitive interface, particularly for mutual fund investments. They also offer access to stocks and IPOs with a focus on ease of use for beginners. Investors can conveniently start SIPs (Systematic Investment Plans) through their platform.

8. 5paisa Capital

5paisa Capital is a discount broker that offers a flat fee brokerage model, making it attractive for frequent traders. They provide access to equities, derivatives, mutual funds, and insurance products.

9. Motilal Oswal

Motilal Oswal is a full-service broker known for its strong research capabilities and advisory services. They offer a wide range of investment products, including equities, derivatives, commodities, and mutual funds.

10. Sharekhan

Sharekhan is a well-established full-service broker with a large network of branches across India. They offer a range of investment products, research reports, and personalized advisory services.

The Role of Technology in Modern Broking

Technology has revolutionized the Indian broking industry, making investing more accessible and convenient than ever before. Online trading platforms, mobile apps, and algorithmic trading tools have empowered investors to take control of their finances and participate actively in the stock market.

Algorithmic Trading

Algorithmic trading, also known as automated trading or algo-trading, involves using computer programs to execute trades based on pre-defined rules. This can help investors automate their trading strategies, reduce emotional biases, and potentially improve execution speed and efficiency. SEBI has guidelines for algorithmic trading to ensure fair market practices.

The Rise of Fintech in Broking

Fintech companies are playing an increasingly important role in the broking industry, offering innovative solutions and disrupting traditional business models. These companies are leveraging technology to provide low-cost trading platforms, personalized investment advice, and seamless user experiences. The growing popularity of UPI (Unified Payments Interface) has also facilitated easier and faster fund transfers for trading accounts.

Beyond Equities: Exploring Other Investment Avenues

While equities are a popular investment option, it’s essential to diversify your portfolio across different asset classes to manage risk and enhance returns. Consider exploring other investment avenues such as:

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers and offer a convenient way to diversify your investments. ELSS (Equity Linked Savings Scheme) funds offer tax benefits under Section 80C of the Income Tax Act.

- Bonds: Bonds are fixed-income securities that represent a loan made by an investor to a borrower (e.g., government or corporation). They offer a relatively stable income stream compared to equities.

- Fixed Deposits: Fixed deposits are a traditional investment option that offers a fixed rate of interest for a specified period. They are considered a safe and low-risk investment.

- PPF (Public Provident Fund): PPF is a government-backed savings scheme that offers tax benefits and a guaranteed rate of return. It is a popular option for long-term savings and retirement planning.

- NPS (National Pension System): NPS is a retirement savings scheme that allows individuals to invest in a mix of equities, bonds, and other assets. It offers tax benefits and is designed to provide a regular income stream after retirement.

Conclusion: Empowering Your Investment Journey

Choosing the right stockbroker is a crucial step towards achieving your financial goals. By carefully considering the factors discussed in this article and comparing the offerings of different brokers, you can make an informed decision that aligns with your investment needs and preferences. Remember to prioritize security, regulation, and transparency when selecting a broker. Conduct thorough research and, if needed, consult with a financial advisor to create a well-diversified investment portfolio that suits your risk tolerance and long-term objectives. Navigating the Indian stock market requires informed decisions, and selecting from the top 10 Indian stock broker options could be your first step toward financial success.