Navigate the Indian stock market with ease! Discover the best online brokers and stock apps in India for seamless trading and investment. Compare platforms, fea

Navigate the Indian stock market with ease! Discover the best online brokers and stock apps in India for seamless trading and investment. Compare platforms, features, and fees to find the perfect stocks app to achieve your financial goals. Start investing today!

Best Stock Trading Apps in India: A Comprehensive Guide

Introduction: Entering the World of Stock Investing in India

The Indian stock market, represented by the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), has witnessed a surge in retail investor participation in recent years. This growth is fueled by increasing financial literacy, easy access to information, and the advent of user-friendly investment platforms. Gone are the days of relying solely on traditional brokers and physical trading floors. Today, a plethora of online brokers and their respective apps empower investors to buy and sell stocks, mutual funds, and other financial instruments with just a few taps on their smartphones.

Choosing the right platform is crucial for a smooth and successful investment journey. This guide provides a comprehensive overview of the best stock trading apps in India, highlighting their key features, benefits, and drawbacks, to help you make an informed decision.

Key Considerations When Choosing a Stock Trading App

Before diving into specific app recommendations, it’s essential to understand the factors that contribute to a good stock trading experience:

- Brokerage Fees: This is perhaps the most significant factor. Different brokers charge varying fees per trade. Look for brokers offering competitive rates, especially if you plan to trade frequently. Some brokers offer zero brokerage on delivery trades, while others charge a flat fee or a percentage of the transaction value.

- Account Opening and Maintenance Charges: Check for any hidden fees associated with opening and maintaining a Demat and trading account. Some brokers offer free account opening, while others may charge a nominal fee. Annual Maintenance Charges (AMC) also vary between brokers.

- User Interface and Experience: A clean, intuitive, and easy-to-navigate interface is crucial, especially for beginners. The app should allow you to easily track your portfolio, place orders, access research reports, and manage your account.

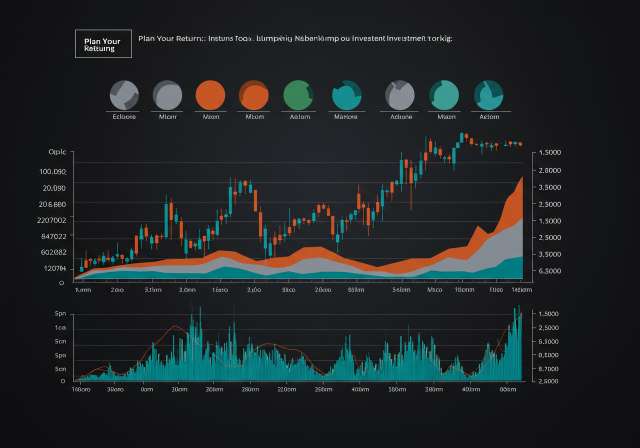

- Trading Features: Evaluate the features offered by the app, such as charting tools, technical indicators, order types (market, limit, stop-loss), and access to derivatives (futures and options) trading.

- Research and Analysis: Some apps offer in-house research reports, stock recommendations, and market news updates. This can be valuable for investors who want to stay informed about market trends and company performance.

- Security and Reliability: Ensure the app has robust security measures to protect your personal and financial information. Look for features like two-factor authentication and data encryption. The app should also be reliable and stable, with minimal downtime.

- Customer Support: Responsive and helpful customer support is essential. Check if the broker offers support through multiple channels, such as phone, email, and chat.

- Investment Options: Consider the range of investment options offered by the app. While most apps allow you to trade stocks, some also offer access to mutual funds, IPOs, bonds, and other assets.

Top Stock Trading Apps in India (2024)

Here’s a look at some of the leading stock trading apps available in India, along with their key features and considerations:

Zerodha Kite

Zerodha is one of the most popular discount brokers in India, known for its low brokerage fees and user-friendly platform. Zerodha Kite, their flagship app, offers a clean and intuitive interface, advanced charting tools, and a wide range of features. The app is available on both Android and iOS devices.

- Pros: Zero brokerage on equity delivery trades, low brokerage on intraday and F&O trades, user-friendly interface, advanced charting tools, direct mutual fund investments.

- Cons: Charges for certain features like call & trade, limited research reports compared to full-service brokers.

Upstox

Upstox is another leading discount broker that has gained popularity among young investors. Their app offers a simple and intuitive interface, making it easy for beginners to get started with investing. Upstox also provides access to a wide range of investment options, including stocks, mutual funds, and digital gold. The availability of options chain data makes this a favourite among more active traders.

- Pros: Competitive brokerage rates, easy-to-use interface, access to multiple asset classes, paperless account opening.

- Cons: Relatively limited research reports, occasional app glitches reported by users.

Groww

Groww is a popular investment platform that focuses on simplicity and ease of use. Their app offers a clean and intuitive interface, making it easy for beginners to invest in stocks, mutual funds, and IPOs. Groww also provides educational resources to help investors learn about the stock market.

- Pros: User-friendly interface, zero commission on mutual fund investments, simplified investing process, educational resources.

- Cons: Limited trading features compared to more advanced platforms, customer support can be slow at times.

Angel One

Angel One is a full-service broker that offers a range of investment services, including stock trading, mutual funds, and investment advisory. Their app provides access to research reports, market news, and expert insights. While their brokerage may be higher than discount brokers, many still use Angel One for its strong research capabilities.

- Pros: Comprehensive research reports, personalized investment advisory, access to multiple asset classes, margin trading facility.

- Cons: Higher brokerage fees compared to discount brokers, account maintenance charges.

5paisa

5paisa is a discount broker that offers a flat fee brokerage model. This means that you pay a fixed fee per trade, regardless of the transaction value. Their app provides access to stocks, mutual funds, and other investment options.

- Pros: Flat fee brokerage, access to multiple asset classes, automated investment tools, research reports.

- Cons: Can be more expensive for high-volume traders, customer support can be improved.

Kotak Securities

Kotak Securities is a full-service broker that offers a wide range of investment services, including stock trading, mutual funds, and IPOs. Their app provides access to research reports, market news, and expert insights. Being a bank-backed brokerage, the ease of funds transfer is a plus point.

- Pros: Strong brand reputation, comprehensive research reports, access to multiple asset classes, integrated banking services.

- Cons: Higher brokerage fees compared to discount brokers, complex account opening process.

Beyond Stocks: Exploring Other Investment Options Through Apps

While focusing on stocks, it’s important to remember that many of these investment platforms also offer access to other valuable investment options relevant to the Indian investor:

- Mutual Funds: Invest in diversified portfolios managed by professional fund managers. Most apps offer a wide selection of mutual funds, including equity funds, debt funds, and hybrid funds. Consider investing through Systematic Investment Plans (SIPs) for disciplined and rupee-cost averaging benefits.

- Initial Public Offerings (IPOs): Apply for shares in companies that are going public. This can be a lucrative investment opportunity, but it’s important to conduct thorough research before investing.

- Government Securities and Bonds: Invest in government-backed securities and corporate bonds for a fixed income stream.

- Exchange Traded Funds (ETFs): Invest in a basket of stocks or other assets that track a specific index or sector. ETFs offer diversification at a low cost.

- Gold: Invest in digital gold through some platforms, offering a convenient way to add gold to your portfolio.

Tax Implications of Stock Investments in India

Understanding the tax implications of your stock investments is crucial for effective financial planning. Here’s a brief overview:

- Short-Term Capital Gains (STCG): If you sell stocks within one year of purchase, the gains are considered STCG and are taxed at a rate of 15% (plus applicable surcharge and cess).

- Long-Term Capital Gains (LTCG): If you sell stocks after holding them for more than one year, the gains are considered LTCG. LTCG exceeding ₹1 lakh in a financial year are taxed at a rate of 10% (plus applicable surcharge and cess).

- Dividend Income: Dividend income from stocks is taxable in the hands of the investor.

It’s advisable to consult with a tax advisor to understand the specific tax implications of your investments and to optimize your tax planning.

The Rise of Robo-Advisors

Another trend in the Indian investment landscape is the rise of robo-advisors. These platforms use algorithms to provide personalized investment recommendations based on your risk profile and financial goals. While not strictly stock trading apps, they often include the option to invest in equities. Robo-advisors can be a good option for beginners who are unsure where to start or for those who prefer a hands-off approach to investing. A robo advisor also factors in considerations such as ELSS investments for tax saving under Section 80C, and investments in instruments such as the Public Provident Fund (PPF) or the National Pension System (NPS).

Conclusion: Choosing the Right Stocks App for Your Needs

The choice of a stocks app depends largely on individual needs and preferences. If you are a beginner, a simple and user-friendly app like Groww or Upstox might be a good starting point. If you are an active trader, Zerodha Kite or 5paisa could be more suitable due to their advanced trading features and low brokerage fees. If you prefer personalized investment advice and comprehensive research reports, Angel One or Kotak Securities might be a better fit. Regardless of your choice, remember to conduct thorough research, understand the risks involved, and invest responsibly. Investing in the stock market can be a rewarding experience, but it’s important to approach it with caution and a long-term perspective. Also, SEBI regulates all stock brokers and investment platforms in India to protect investors, so it is crucial to choose a SEBI-registered broker. Happy investing!